Although they are decreasing their operating leverage, the decreased risk of insolvency more than makes up for it. As you can see from this example, moving variable costs to fixed costs, such as making hourly employees salaried, is riskier in that fixed costs are higher. However, the payoff, or resulting net income, is higher as sales volume increases. Managerial accountants also tend to calculate the margin of safety in units by subtracting the breakeven point from the current sales and dividing the difference by the selling price per unit. Similarly, in the breakeven analysis of accounting, the margin of safety calculation helps to determine how much output or sales level can fall before a business begins to record losses. Hence, managers use the margin of safety to make adjustments and provide leeway in their financial estimates.

Do you own a business?

That’s why you need to know the size of your safety net – what your accountant calls your “margin of safety”. As a start-up, with a couple of years loss-making to work through, getting to breaking even is an accomplishment. More established companies want to stay as far away single entry system definition from their break-even point as possible. Also, remember, Minnesota Kayak Company needs to sell 28 kayaks at $500 each to break even. While it may be important to a degree, there are likely other factors that eclipse it in terms of overall importance in an investing strategy.

What Is Break-Even Analysis?

- For example, using your margin of safety formulas to predict the risk of new products.

- £20,000 is a comfortable margin of safety for Company 1, but is nowhere near enough of a buffer from loss for Company 2.

- To work out the production level you need to make a profit, you can also work out the margin of safety in units.

- You never get too near that break-even point, or tumble unknowingly into being unprofitable.

- A higher margin of safety is good, as it leaves room for cost increases, downturns in the economy or changes in the competitive landscape.

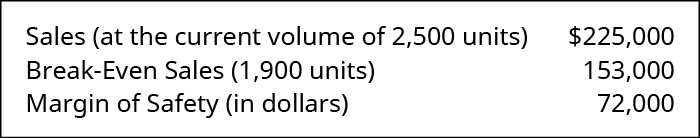

Managers can utilize the margin of safety to know how much sales can decrease before the company or a project becomes unprofitable. It is an important number for any business because it tells management how much reduction in revenue will result in break-even. Management uses this calculation to judge the risk of a department, operation, or product. The smaller the percentage or number of units, the riskier the operation is because there’s less room between profitability and loss. For instance, a department with a small buffer could have a loss for the period if it experienced a slight decrease in sales. Meanwhile a department with a large buffer can absorb slight sales fluctuations without creating losses for the company.

Understanding the Margin of Safety Formula and Calculation

Margin of safety determines the level by which sales can drop before a business incurs in operating losses. Taking into account a margin of safety when investing provides a cushion against errors in analyst judgment or calculation. It does not, however, guarantee a successful investment, largely because determining a company’s “true” worth, or intrinsic value, is highly subjective.

Benefits Of Investing With A Margin Of Safety

Operating leverage is a function of cost structure, and companies that have a high proportion of fixed costs in their cost structure have higher operating leverage. In fact, many large companies are making the decision to shift costs away from fixed costs to protect them from this very problem. Margin of safety, also known as MOS, is the difference between your breakeven point and actual sales that have been made. Any revenue that takes your business above break even can be considered the margin of safety, this is once you have considered all the fixed and variable costs that the company must pay.

How Do Businesses Use the Break-Even Point in Break-Even Analysis?

All of our content is based on objective analysis, and the opinions are our own. Financial forecasts adjustments like this make the margin of safety calculator necessary.

Like any statistic, it can be used to analyse your business from different angles. There may not be an ideal margin of safety for investors, but as a general rule of thumb, the wider the margin, the more room they have to be wrong. It’s difficult to say if there’s an ideal margin of safety for any particular investor. But we can say that the larger the margin of safety is, the more room an investor has to be wrong — which isn’t necessarily a bad thing. With that in mind, a larger or wider margin of safety is probably better for most investors. To try and correct for this possibility, value investors can determine their margin of safety when entering a position.

To provide a substantial cushion for potential losses, an investor could plan to enter into a trade at a price lower than its intrinsic value. For example, if he were to determine that the intrinsic value of XYZ’s stock is $162, which is well below its share price of $192, he might apply a discount of 20% for a target purchase price of $130. In this example, he may feel XYZ has a fair value at $192 but he would not consider buying it above its intrinsic value of $162.

The five components of break-even analysis are fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP). We will return to Company A and Company B, only this time, the data shows that there has been a \(20\%\) decrease in sales. In other words, Bob could afford to stop producing and selling 250 units a year without incurring a loss. Conversely, this also means that the first 750 units produced and sold during the year go to paying for fixed and variable costs. The last 250 units go straight to the bottom line profit at the year of the year. This is because it would result in a higher break-even sales volume and thus a lower profit or loss at any given level of sales.

If customers disliked the change enough that sales decreased by more than 6%, net operating income would drop below the original level of $6,250 and could even become a loss. In investing, the margin of safety represents the difference between a stock’s intrinsic value (the actual value of the company’s assets or future income) and its market price. The margin of safety essentially represents the difference between the intrinsic value of a security and its current market price and serves as a shield for investors against potential losses. In investing, the margin of safety formula is a way for investors to be extra careful when selecting an entry point in a security. By determining a percentage and placing a discount to a stock’s estimated value, an investor can find a mathematical framework with which they can try to be safer with their money. After determining the intrinsic value of a stock, an investor could simply buy it if the current market price happens to be lower.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. The company can also invest its funds for expansion of the company or other purposes without worrying about hitting the bottom line anytime soon. Generally, a high degree of security is preferred, which shows the company’s resilience in the face of market uncertainty.